With insurers increasingly shifting risk to property owners through percentage deductibles, insured losses from events like hurricanes and floods can be devastating. Discover how brokers can use DOXA’s strategic solutions to minimize the impact of these deductibles and protect their clients.

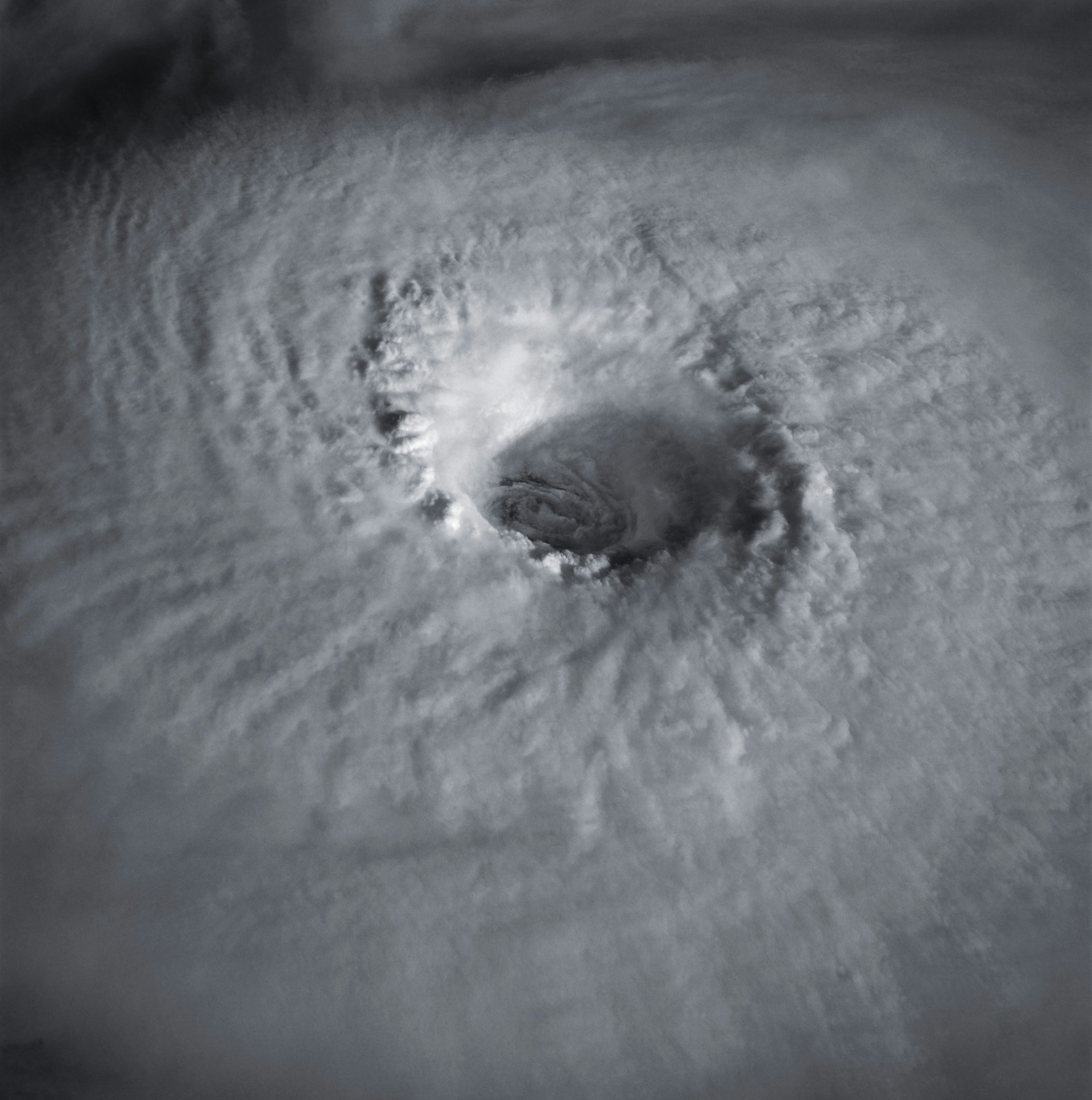

When a catastrophe such as a hurricane or earthquake strikes a wide area, the insured losses can easily add up to billions of dollars. For example, it’s estimated that Hurricane Milton’s insured losses will range from $30 billion – $50 billion, the largest insured loss since Hurricane Ian. As property values have risen, so have insurers’ catastrophe losses. To limit their own risks, carriers are increasingly requiring property owners to retain a greater share of the exposure through percentage deductibles.

DOXA’s expertise in structuring custom coverage solutions ensures brokers can guide their clients toward policies that mitigate these risks effectively. By leveraging DOXA’s deep industry relationships and advanced risk analysis tools, brokers can identify policies that offer more favorable deductible terms and lessen the financial impact on their clients.

As insurers tallied their losses after Hurricane Andrew devastated Florida in 1992, they recognized the potential for catastrophic financial exposure. Thirteen years later, Hurricane Katrina confirmed their fears, with nearly $41 billion in insured losses. In response, the insurance industry implemented percentage deductibles to shift more financial responsibility to property owners.

This shift accelerated following Hurricane Sandy in 2012, which prompted insurers to extend percentage deductible applications beyond the Gulf Coast to the entire eastern seaboard. Today, these deductibles are a reality for many property owners in hurricane-prone regions. DOXA works with brokers to educate clients on these evolving market conditions and structure policies that provide optimal financial protection. By proactively addressing these challenges, brokers can position themselves as trusted advisors, helping clients navigate the complexities of catastrophe risk management.

Hurricanes, earthquakes, flooding, and hail can all trigger percentage deductibles. These deductibles, often applied in coastal and high-risk areas, significantly increase a policyholder’s out-of-pocket expenses. For example, a building valued at $1 million with $500,000 in contents and $400,000 in business income exposure would face a $95,000 deductible under a 5% named storm provision.

DOXA helps brokers negotiate policies that limit these deductibles to reduce financial exposure for insureds. By assessing policy language and advocating for tailored coverage, DOXA ensures clients receive the most favorable terms possible. Additionally, DOXA provides educational resources to brokers, equipping them with the knowledge to explain these complex provisions to their clients effectively.

Before Hurricane Sandy, most insurers imposed percentage deductibles only in Gulf Coast states and along the southeastern seaboard. However, following Sandy’s widespread damage in New York and New Jersey, insurers broadened the scope of these provisions. Today, named-storm deductibles apply to areas as far north as Maine, impacting commercial property owners and businesses across a vast geographic region.

DOXA continuously monitors market trends and regulatory changes to help brokers anticipate shifts in underwriting practices. By staying ahead of these developments, brokers can offer proactive solutions that safeguard their clients against unexpected financial burdens.

While insurers are insisting on percentage deductibles, brokers can implement strategies through DOXA’s tailored solutions to lessen their clients’ financial burden.

By structuring coverage in this way, DOXA ensures that clients are not overburdened by blanket percentage deductibles that may not accurately reflect their actual exposure.

One emerging solution to offset high percentage deductibles is parametric insurance. Unlike traditional policies that reimburse based on actual damage assessments, parametric policies provide pre-agreed payouts when specific conditions (e.g., wind speed thresholds or earthquake magnitudes) are met.

DOXA helps brokers explore the potential of parametric insurance as a complementary risk transfer tool. By integrating parametric solutions into a broader risk management strategy, brokers can offer clients faster financial recovery after catastrophic events.

As property values continue to rise, storms become more frequent, and losses from hail and flooding increase, carriers are shifting more risk onto insureds. DOXA equips brokers with the strategies and coverage solutions needed to help clients manage these increasing financial burdens. With a deep understanding of catastrophe modeling and policy structuring, DOXA ensures brokers can offer their clients superior protection against major losses.

By partnering with DOXA, brokers gain access to:

As the insurance industry continues to adapt to increasing catastrophe risks, brokers who proactively address deductible challenges will differentiate themselves as trusted advisors. DOXA stands ready to support brokers with innovative solutions that protect their clients and enhance long-term resilience.

Contact DOXA today to explore solutions that minimize deductible impact and strengthen your clients’ resilience.

Related posts

Once considered a niche segment of the insurance industry, MGAs (Managing General Agents) have surged into the spotlight as significant drivers of innovation, specialization, and strategic growth. The growth of the specialty insurance market has...

Continue Reading

FORT WAYNE, Ind.— Nov. 4, 2025 — DOXA announces the acquisition of American Hole ‘n One (AHNO), one of the largest providers of hole-in-one insurance and event promotions. The acquisition...

Continue Reading