California’s wildfire crisis is pushing the state’s insurance industry to a breaking point. With flames consuming neighborhoods in Los Angeles and beyond, the debate about how insurers can model and manage risk has reached a fever pitch. The accelerating impacts of climate change make wildfires not just a seasonal challenge but a persistent, year-round threat.

Why It Matters

California’s insurance market is already undergoing reforms to address the escalating costs of wildfire risk. However, these measures may not be swift or comprehensive enough to stabilize the market.

Some experts argue that the state may need to step in as a primary insurer for fire risks, akin to its role with earthquake insurance and Florida’s model for hurricanes. But transitioning to such a system is fraught with challenges, particularly given the billions of dollars at stake.

The Big Picture

Climate change has fundamentally altered California’s wildfire landscape. Fires that were once concentrated in summer months now ignite regardless of the season. This new normal has created an untenable situation for insurers:

The cyclical relationship between the FAIR Plan and traditional insurers exacerbates the problem. As FAIR Plan takes on more customers, private insurers are further incentivized to withdraw from fire-prone areas, intensifying reliance on the FAIR Plan.

In a September 2024 bulletin, California Insurance Commissioner Ricardo Lara warned:

“When the FAIR Plan takes on more customers, it causes traditional insurance companies to withdraw from certain areas, further increasing dependence on the FAIR Plan. This cycle can ultimately weaken the FAIR Plan’s financial stability and limit consumer choice.”

By the Numbers

The FAIR Plan’s exposure has ballooned dramatically:

While the FAIR Plan has mechanisms to share its financial burden with other insurers, this comes with its own pitfalls. Insurers can pass these costs onto policyholders, leading to rising premiums across the board.

Recent Reforms

The California Department of Insurance (CDI) has rolled out a “Sustainable Insurance Strategy” aimed at addressing these pressures. Key components include:

While these measures aim to stabilize the market, they’ve faced significant pushback. Critics argue that these changes may lead to rapidly escalating premiums without a corresponding expansion of coverage.

The Insurance Information Institute, however, remains optimistic, noting that these reforms have prompted some insurers to re-enter the market and expand coverage.

Complicating Matters

This week’s fires underscore the fragility of California’s insurance market. Early estimates suggest the losses could be significant enough to disrupt even recent stabilization efforts.

Jeremy Porter, head of climate implications research at First Street Foundation, highlights the broader implications:

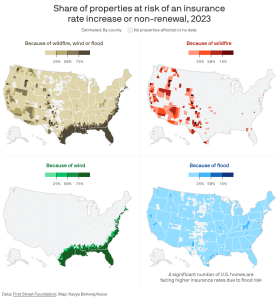

“All of those fees, all of those insurance premiums, they’re all going to adjust upward as we talk about risk.”

In other words, Californians may need to accept higher costs as the true price of living in wildfire-prone areas becomes clearer.

A System Under Pressure

The sustainability of California’s insurance model is increasingly in question. As losses mount and more insurers retreat, the state faces difficult decisions:

Michael Wara, a senior research scholar at Stanford, captures the urgency of the moment:

“The current model may just not be sustainable. We need to have a much bigger conversation about the structure and assumptions that underlie this rate-regulated industry.”

Lessons from Other States

California isn’t the only state grappling with climate-driven insurance challenges. Florida’s experience with hurricanes offers both cautionary tales and potential solutions:

These parallels suggest that while state intervention can provide short-term stability, it may not address the underlying risk dynamics.

Looking Ahead

The current fires raging across California are a stark reminder of the challenges ahead. While it’s too early to calculate the full scope of damages, the implications for the state’s insurance industry are profound.

Policymakers, insurers, and homeowners must confront the reality of a changing climate. The solutions will not be simple, and trade-offs are inevitable. Balancing affordability, access to coverage, and the financial viability of insurers will require bold, innovative thinking.

At DOXA, we believe that navigating today’s complex insurance landscape requires collaboration, innovation, and a commitment to sustainability. As the industry grapples with the challenges posed by climate change, we are dedicated to empowering insurance professionals with the tools and insights they need to succeed.

Let’s connect and discuss how we can work together to build a more resilient future. Reach out to us today to explore solutions tailored to your needs.

Related posts

Once considered a niche segment of the insurance industry, MGAs (Managing General Agents) have surged into the spotlight as significant drivers of innovation, specialization, and strategic growth. The growth of the specialty insurance market has...

Continue Reading

FORT WAYNE, Ind.— Nov. 4, 2025 — DOXA announces the acquisition of American Hole ‘n One (AHNO), one of the largest providers of hole-in-one insurance and event promotions. The acquisition...

Continue Reading