The Future Isn’t Coming—It’s Here: How AI and Data Are Reshaping the Underwriting Landscape

It’s no secret that technology has redefined nearly every sector of the global economy. From logistics to life sciences, digitization has delivered measurable efficiency gains, productivity spikes, and—often—supercharged profitability. But if we’re honest about the insurance industry’s own transformation story, especially on the carrier side, the results aren’t quite as dazzling.

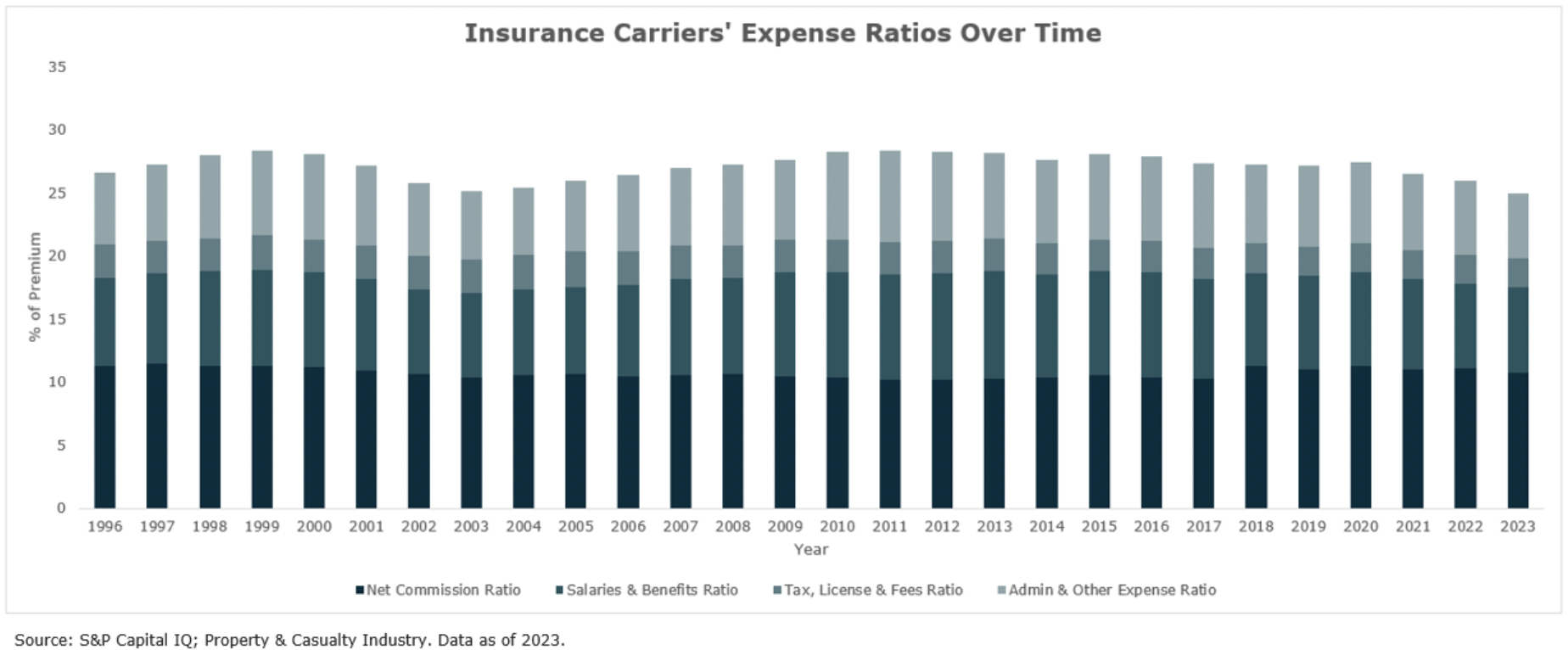

Let’s talk numbers. One clear metric for assessing technology’s impact is the evolution of the expense ratio, especially the components of salaries & benefits and administration & other over the past 30 years. The hope has always been that tech would empower insurance carriers to do more with less. But when you chart the data, reality paints a more muted picture. The industry has seen minor improvements—but much of that can be attributed to cyclical rate hardening, not structural tech gains.

So, where is the real transformation happening?

The answer lies not with traditional carriers, but with delegated authority firms—MGAs, MGUs, and program administrators. These firms have proven far more nimble, leveraging their leaner structures to gain significant ground. The next frontier of growth and differentiation lies at the intersection of AI and big data—a convergence poised to redefine underwriting, risk selection, and profitability itself.

Underwriting, at its core, has always been about collecting relevant data and making sound decisions. Historically, this process has been periodic—an underwriter takes a snapshot of a risk at a given point in time and builds a policy around it.

But that model is rapidly becoming outdated.

Today’s data environment is radically different. From IoT devices to digital payment histories, from social media signals to real-time GPS data, the availability of actionable, high-frequency data is unprecedented. AI doesn’t just keep up—it thrives in this ecosystem. It can analyze vast troves of structured and unstructured data in real time, surfacing patterns that a human underwriter might never spot.

Imagine underwriting as a living, breathing process. A restaurant that shifts its closing time from 10 PM to 2 AM might significantly change its risk profile. Traditional underwriting wouldn’t catch that until renewal—if ever. With continuous data feeds, AI can flag this behavior immediately, prompting real-time policy adjustments. This isn’t a pipe dream—it’s already happening.

To unlock AI’s full potential, firms need to start by modernizing their data infrastructure. In most insurance operations today, data is siloed, stored in legacy systems that don’t talk to each other. These outdated tech stacks stifle innovation, prevent holistic analysis, and drag down productivity.

The solution is a single source of truth: a centralized, cloud-based data environment that connects every corner of the business. Once you achieve that level of integration, the benefits compound. Digitization becomes scalable. Insights become deeper. Operations become faster.

For M&A-minded firms, this kind of digital backbone also enhances enterprise value. Buyers are increasingly looking at tech readiness as a core valuation lever. At DOXA, we’ve seen firsthand how firms that embrace centralized data and smart systems command stronger multiples and accelerate integration post-acquisition.

One of the more fascinating innovations emerging from AI-driven underwriting is the ability to monitor and understand agent behavior on digital platforms. Consider this: what if your underwriting model could detect when an agent is altering application inputs in ways that consistently push risks into better pricing tiers?

AI can flag those patterns—not to punish agents, but to refine risk appetite, identify coaching opportunities, and build a more nuanced behavioral underwriting layer.

It’s not about catching bad actors; it’s about raising the bar for the entire distribution chain.

There’s no denying the talent crunch facing the insurance industry. Every broker, MGA, and carrier leader is wrestling with the same question: how do we grow in a world where experienced underwriters are increasingly hard to find?

The answer lies in automation and scalability.

A well-architected digital underwriting platform doesn’t just streamline decision-making—it expands capacity without expanding headcount. Repetitive tasks can be automated. Risk assessment can be pre-screened by AI models. Workflows can be standardized, reducing variability and improving compliance.

The result? Your top underwriters get to focus on high-impact work, while the system handles the rest. In M&A terms, this isn’t just operational efficiency—it’s strategic leverage.

Delegated authority firms that embrace this transformation are positioning themselves as future-ready—and making themselves highly attractive to acquirers like DOXA.

We’re not just looking for firms with strong books of business. We’re looking for firms that:

Have a clear data strategy

Are investing in underwriting modernization

Understand how to use AI not just as a buzzword but as a business enabler

Are prepared to scale without relying solely on talent acquisition

Digital infrastructure is no longer a “nice to have.” It’s becoming table stakes.

The competitive advantage of tomorrow won’t be legacy relationships or brute force growth. It will be speed, intelligence, and adaptability—all things AI and data deliver.

The window for gaining a first-mover advantage is closing. What looks like differentiation today will be mandatory tomorrow.

Delegated authority firms that move now can reap early returns—faster quoting, better loss ratios, stronger compliance—but more importantly, they’ll future-proof their operations against the fast-approaching expectations of the market.

And for firms considering a capital event or an acquisition in the next 12–36 months, now is the time to make that investment.

At DOXA, we’re actively partnering with firms that see where the market is headed and want to be at the forefront—not catching up from behind. Whether you’re looking to scale, optimize, or transition ownership, we’re here to help you harness technology’s full potential.

Transformation isn’t easy. But it’s essential. The good news? You don’t have to go it alone.

If you’re a founder, principal, or executive at an MGA, MGU, or PA and want to explore how modernization impacts valuation and M&A readiness, let’s talk.

DOXA brings more than capital—we bring experience, infrastructure, and a shared commitment to evolving the insurance industry, together.

#innovation #management #technology #strategy #productivity #insurance #MGA #underwriting #AI #data #digitaltransformation #mergersandacquisitions #DOXA

Related posts

Once considered a niche segment of the insurance industry, MGAs (Managing General Agents) have surged into the spotlight as significant drivers of innovation, specialization, and strategic growth. The growth of the specialty insurance market has...

Continue Reading

Every successful specialty insurance program starts with an underwriter who sees a unique opportunity – a segment that needs better capacity, sharper underwriting, or a new approach to risk. DOXA exists to help those underwriters turn their vision into reality. ...

Continue Reading