The insurance brokerage industry is at a crossroads. Fewer firm owners are discussing internal perpetuation—the process of passing the business to trusted leaders or family members—opting instead for external sales in a marketplace defined by high valuations and aggressive consolidation. On the surface, this trend might appear concerning for the survival of independent brokerages, but is it necessarily a bad thing?

The Legacy of Independence

For decades, independent brokerages thrived on a foundation of family ownership. Generational transitions were the norm, fostering trust and continuity with clients. Names on company doors often carried the weight of family history, symbolizing dedication to independence.

However, today’s marketplace tells a different story. A growing number of brokerage owners no longer see internal perpetuation as a viable option. The result? A dramatic increase in external sales. For example, in 2014, 17.6% of firms experienced ownership transfers exceeding 10%, compared to only 10% in 2023.

Why Internal Perpetuation Is Losing Ground

The Valuation Gap

At the heart of this shift is the valuation gap—the significant difference between what an external buyer is willing to pay versus what an internal buyer can afford. External buyers often bring strategic motivations, access to capital, and a willingness to pay higher multiples on earnings.

Internal buyers, typically senior leaders or employees, often lack the financial resources to match these offers. They rely on cash flow to fund the purchase, limiting their ability to meet the seller’s expectations. As a result, external sales can yield 50–100% higher valuations than internal transactions.

Operational Challenges

Running an independent brokerage today is no small feat. Fierce competition, talent shortages, and pressures for consistent growth consume owners’ focus, often sidelining long-term perpetuation planning. Many firms lack a clear strategy, making internal transitions not only difficult but also impractical.

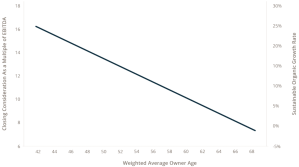

Changing Demographics

The weighted average owner age (WAOA) in insurance brokerage is 54 years, with 80% of shareholders aged 44 or older. This aging ownership base struggles to sustain the organic growth required for internal perpetuation, often opting for external sales instead.

A Tale of Two Mindsets

Internal Perpetuation

Internal perpetuation is more than a transactional process; it’s a mindset. Firms committed to this path invest in organic growth, leadership development, and operational efficiencies. They focus on building a culture of continuous improvement, where employees are excited about long-term ownership opportunities.

But internal perpetuation is not easy. It requires early and consistent planning, financial discipline, and a commitment to recruiting and retaining top talent. Without these efforts, firms often find themselves forced to sell externally.

External Sales

On the other hand, external sales often prioritize short-term valuation gains. Owners preparing for such a sale focus on improving profitability and organizational attractiveness to buyers. While this approach might lack the emotional resonance of internal perpetuation, it offers clear financial advantages in today’s market.

The Challenges of Internal Perpetuation

Despite its idealistic appeal, internal perpetuation is fraught with obstacles:

In a DOXA study, 79% of owners believed their leaders could take over the business, but 77% lacked an ownership strategy for key employees. This disconnect underscores the difficulty of turning aspirations into action.

The Path Forward

Remaining independent is more than a declaration; it requires deliberate action. Firms committed to independence must focus on:

By embedding these principles into their operations, firms not only increase their chances of successful internal perpetuation but also enhance their valuation for a potential external sale.

Why Owners Still Dream of Independence

Despite the challenges, many owners remain emotionally tied to the idea of independence. For some, it’s about preserving a family legacy. For others, it’s the ability to maintain control over the firm’s culture and operations.

Yet, the harsh reality is that staying independent often requires taking on additional risk, particularly as firms grow larger and more complex. For many, partnering with or selling to another firm provides the resources needed to remain competitive in an evolving market.

The Future of the Independent Brokerage

The independent brokerage model isn’t going extinct; it’s evolving. For every firm that sells, new ones emerge, driven by entrepreneurial spirit and market demand. What’s changing is the narrative around perpetuation. Owners are less likely to make bold proclamations about independence without a concrete plan to back it up.

Firms that prioritize operational excellence, talent development, and long-term value creation position themselves for success—whether they choose to perpetuate internally or sell externally.

Bottom Line: Independence by Design

The decision to sell externally or remain independent isn’t binary—it’s about preparing for both. By running their businesses as if they’re always for sale, owners create the flexibility to choose their path. This approach ensures they can either transition to the next generation of leaders or maximize value through an external sale.

At DOXA, we believe in empowering firms to thrive in any scenario. Whether you’re charting a course for internal perpetuation or exploring external opportunities, our team is here to help you navigate the complexities of ownership transitions.

Are you ready to secure the future of your brokerage? Connect with DOXA today and discover how we can help you achieve your goals.

Related posts

FORT WAYNE, Ind.— Nov. 19, 2025 — Promont, a DOXA company, is pleased to announce the launch of FranchisorSuite and Real Estate ProSuite, as part of an expanded collection of specialty solutions that provide streamlined protection for franchisors and real estate professional firms. The two refreshed...

Continue Reading

FORT WAYNE, Ind.— Nov. 4, 2025 — DOXA announces the acquisition of American Hole ‘n One (AHNO), one of the largest providers of hole-in-one insurance and event promotions. The acquisition...

Continue Reading